Mark Littler returns with his monthly look at the world of whisky auctions.

WELCOME back, and welcome to September. This month we come to you with tales of the Elchies as we chat about the split that is appearing in the whisky bottle market.

As we begin autumn, there are signs of softening across areas of the market, with variation between different portions of the market as to how much. The trend is not a surprising one given the current economic climate and the huge growth we had seen earlier in the year.

Throughout the summer, we saw significant growth across a number of series, especially modern bottlings, but also across other vintage series too. This has a predictable impact on the market: collectors flood the market in response to the sharp growth, hoping to capitalise, this then means there are more sellers than buyers, which causes prices to soften. This is likely what we are seeing with the likes of the Macallan Folio one, which peaked at £16,000 earlier in the year and is now stabilised around £11,000 to £12,000.

In addition to that, people are becoming more aware of the changing global economic situation in response to the Ukraine war and subsequent energy crisis. While plenty of people will still be looking for alternative assets such as whisky bottles, many buyers will simply choose to pause their collecting while cash flows are uncertain; however there may also be collectors looking to liquidate their collections to make ends meet. This means it is more likely for an increase in the number of bottles reaching the market, but with potentially fewer buyers than earlier in the year. It is this imbalance between bottles and buyers that can cause a softening of prices.

A good example from the modern side of the market is the Easter Elchies Black 2020 release. The bottling reached highs of £2,150 in June. Then, as the August auctions drew to a close, prices were as low as £950 and didn’t top £1,200.

Another Elchies in our tale is the Macallan Easter Elchies 2012 ribbon bottling. This bottling has been performing strongly over the past 12 months, with prices reaching £4,750 in August, having been just £3,800 at the end of 2021 and just £2,100 at the start of 2021. That being said, the most recent auction price has dropped back to £3,800 and, over the past month across The Macallan ribbon series, we have seen drops of £600 to £800 or bottles not meeting their reserve.

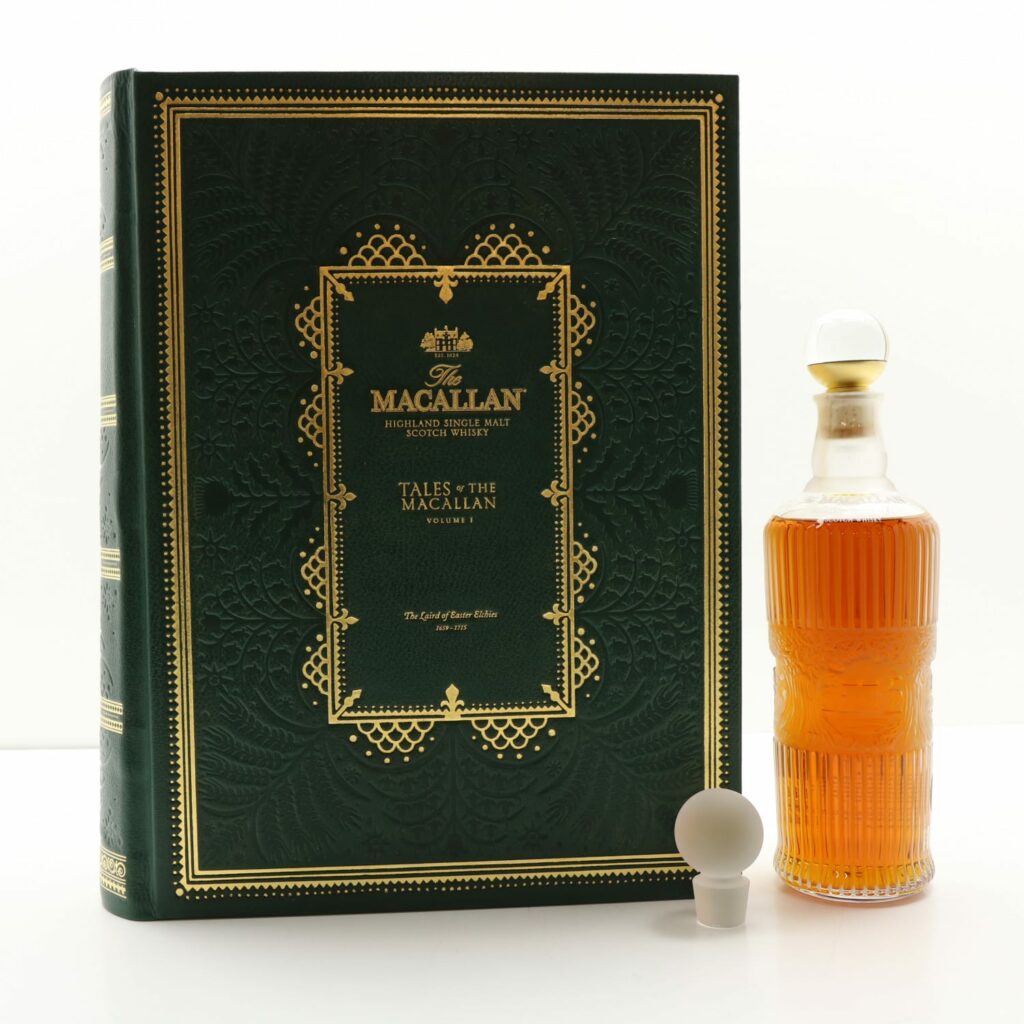

At the super premium end of the market, we have seen more stability for high value bottles that have the age statement, vintage, and presentation to back up their prices. The final Elchies for this month is The Tales of The Macallan Volume 1, 1950 71 year old in Lalique. This is a stunning 71-year-old whisky in great presentation, with a name that alludes to the potential for a series. The prices have been fairly consistent through 2022 and, importantly, the most recent sale in September has bucked the slight softening trend seen in the other sections.

There are other variations within the market of course. The jubilee-themed bottlings available from various bottlers have been showing serious growth this year in response to Queen Elizabeth’s platinum jubilee being celebrated earlier in the summer. The passing of the Queen in early September marks the end of an era for the UK and for the distilleries that have spent the past 70 years releasing limited edition bottlings to mark the various significant jubilees.

The knock on effect across the year means that royal-themed bottlings are one section of the secondary market that doesn’t seem to be softening. The Macallan Diamond Jubilee bottling reached an all time high of £12,500 at the most recent sale, up from £6,200 in January.

It is, of course, important to stress that the softening is relatively light and not uniform across the market. The secondary market is global and as such relatively resilient. We saw similar trends in prices during 2019 after the sharp peaks in value of 2018. As such we expect the long-term forecast to remain positive.

If you have whisky bottles that you would like help selling then please get in touch with me and I will be happy to assist you.

Mark Littler is an independent whisky broker, market analyst, and consultant, with over a decade of experience in the industry. Each week, he publishes videos on his YouTube channel about topics such as cask investment fraud (and how to avoid it), the history of distilleries and bottles, debunking whisky investment myths, and much more. For more information visit www.marklittler.com

Plus, read more news and reviews on Scottish Field’s whisky pages.

TAGS